Consultants hired by the Metro Development and Housing Agency shared new findings about the city’s development districts at a specially convened meeting of Metro’s Tax Increment Financing (TIF) Study and Formulating Committee on Tuesday.

The powerful real estate tool, in which the city helps finance private development, coincided with property value increases of 1,200 percent in TIF-adjacent neighborhoods like the Gulch and Rolling Mill Hill from 2000 to 2021, compared to a 360 percent property value increases over the same time period county-wide. The report was required by a Metro Council ordinance passed at the TIF committee’s recommendation.

At-Large Councilmember, former Budget and Finance chair and all-around fiscal wonk Bob Mendes heads the committee. “The report showed that TIF districts have appreciated in value much more rapidly than the rest of the city,” Mendes tells the Scene. At the core of TIF scrutiny is the extent to which it warps the real estate market, using property tax revenue to create lucrative pockets of development for private developers. “As we work our way through the current affordable housing crisis, we’ll have to figure out whether TIF helped or hurt that crisis.”

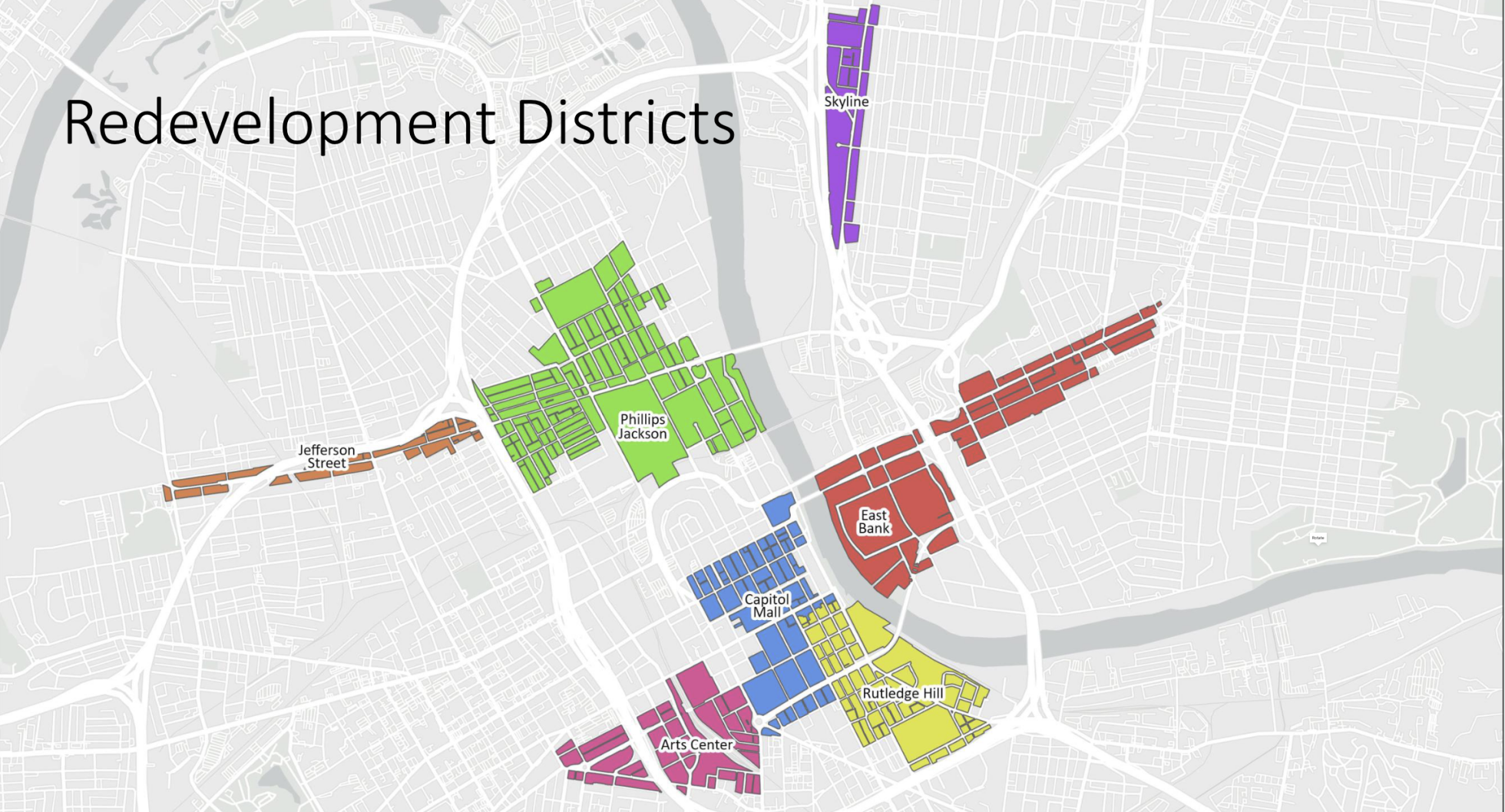

The city has used TIF for decades to make building cheaper for private real estate developers. It’s a broad term that refers to a type of dealmaking in which the city borrows money on behalf of a developer and counts the developer’s property taxes as repayment. Theoretically, those taxes increase quickly enough to justify the city’s expense, development spreads, and an area becomes more expensive and therefore generates more tax dollars. Tax-increment financing in Nashville is behind development in the Gulch, Germantown, downtown, Rolling Mill Hill and East Nashville. With a few exceptions, MDHA brokers the borrowing and lending behind these deals. Here is a handy map.

The TIF Study and Formulating Committee convened in 2019 to study the city’s use of TIF, which has been criticized as an insiders’ game between Metro executives and developers and a profit-boost for development that would have happened anyway. This chicken-and-egg problem is the core slipperiness of TIF: Is the city using tax dollars to incentivize development that would have happened anyway, essentially just helping developers get bigger margins, or is it using a creative financing strategy to attract investment? The committee recommended MDHA formally study TIF practices, the findings of which brought the group back together.

The mayor's office typically works closely to oversee the use of TIF. Once a fierce critic of these deals, Mayor John Cooper railed at TIF as overused public giveaways as a candidate, pledging in campaign materials to explore their potential to bring grocery stores to food deserts. Yesterday's meeting comes ahead of an expected TIF push on the East Bank, where, according to Metro officials and acknowledged Tuesday night from Mendes, the city is preparing to use the financing tool to facilitate private non-stadium development.

“While it’s been three years since the committee wrapped up its work, I’m glad MDHA was able to complete this study,” Mendes tells the Scene. “It’s going to be important as the city looks at how to use TIF in the future.”

Former Mayor Bill Purcell and current MDHA Executive Director Troy White introduced the findings, presented by Anita Morrison and Abigail Ferretti of D.C.-based firm Partners for Economic Solutions. White acknowledged the conceit of the whole presentation. “What the study can not show you is whether the development would have happened with or without TIF,” said White. “This is something we can all debate and discuss and have opinions on in hindsight.”