Nashvillians elected John Cooper because they thought he would see to it that prosperity would be better, if not equally, distributed around the city and to rein in spending, and to address debt problems. I am confident he will fix the problems we’ve laid before him. Plugging the $41.5 million hole in the current budget is a substantial task to tackle as he’s just a couple months into office. But neither Mayor Cooper nor At-Large Metro Councilmember Bob Mendes, the council’s budget and finance chair, is new to this game. Their experience on the Metro Council and in business should enable them to handle our debt and budget challenges.

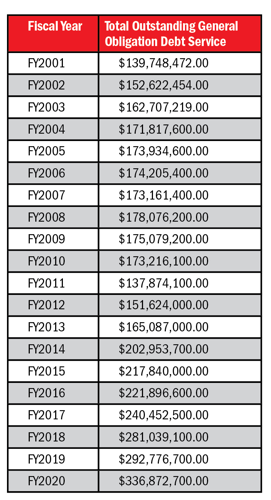

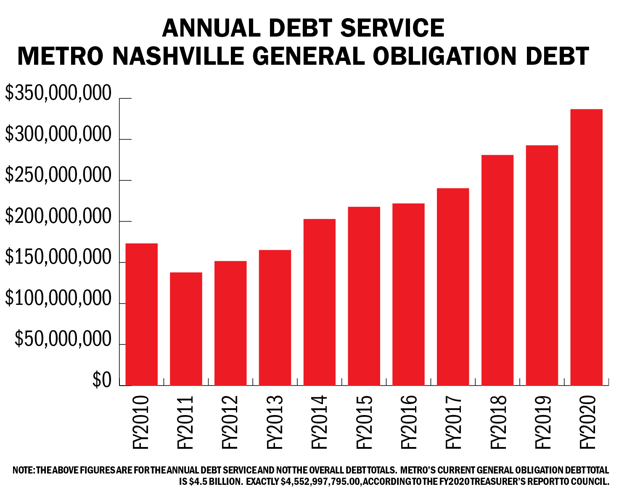

Nashville is at a crossroads, which Tennessee Comptroller Justin Wilson recently detailed. Over the past several years, Nashville’s political leaders have turned their backs on addressing the city’s budget challenges. There have been calls to examine where exactly we took the wrong turns and where we failed to get back on the right path, and I don’t disagree with them. We need to identify mistakes so we can avoid them in the future. But the financial problem facing us is one that cannot be fixed easily. The significant rise in our annual debt service payments — partially as a result of having to eat the increased interest payments from Metro’s decision to refinance a significant portion of our outstanding debt during the Great Recession — is a problem that will take decades to resolve. We will be continuing to pay down our debt burden until at least 2040, according to the 2020 Treasurer’s Report to Council presentation.

We’ve been warned repeatedly by the credit rating agency Moody’s to avoid increasing that debt burden. They downgraded Nashville’s bond rating in 2014 as a result of our then-significant debt as well as a reduction in cash reserves. One would think that a city would heed that warning and work toward eliminating our debt more efficiently and increasing our cash reserves.

But we haven’t. It’s only gotten worse. In FY2015, our debt payments ate up 10 percent of our budget and cost Nashville $189 million. Since then, our debt service payments have risen to eat up 14 percent of a much larger budget, which will cost us $326.4 million this year. In five years, our annual payments to chip away at our debt have nearly doubled!

And don’t forget: That debt service payment is not a figure of how much our city owes overall. Debt service is simply the annual payment toward the city’s debt. Our total outstanding general obligation debt currently sits at $4.55 billion, according to the FY2020 Treasurer’s Report to Council, up from $3.96 billion in 2017.

So our debt has continued to rise despite multiple warnings that it must be lowered.

Why? Well, that is a question for tomorrow. Today’s problem is finding a practical solution for our current budget shortfall and avoiding a state takeover of Metro’s finances.

The revenues are there, and our current $2.33 billion budget is $101 million larger than last year. But that growth is still not sufficient to close the deficit.

Mayor Cooper can do the job, and we will trust that he holds to Thomas Jefferson’s third Canon of Conduct: “Never spend your money before you have it.”

Quite frankly, we should have been following it already.

Bill Freeman

Bill Freeman is the owner of FW Publishing, the publishing company that produces the Nashville Scene, Nfocus, the Nashville Post and Home Page Media Group in Williamson County.