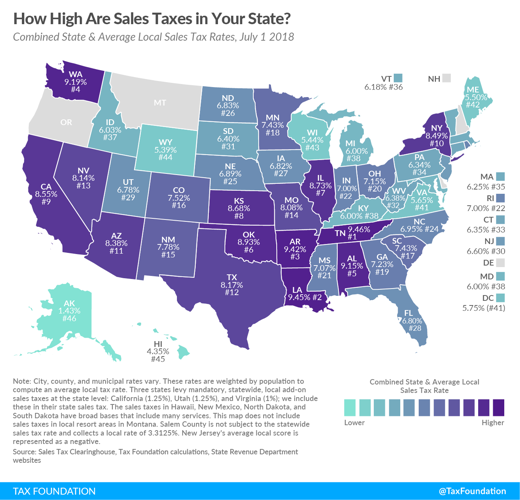

Tennessee now has the highest sales tax in the country, with an average combined local/state rate of 9.46 percent.

The jump from second to first came after Louisiana legislators lowered the state’s rate from 5 percent to 4.45 percent, dropping the average combined local/state rate from 10.02 percent to 9.45, just .01 percent lower than Tennessee’s average.

Where Louisiana’s two taxes are nearly evenly distributed, Tennessee leans more heavily on state taxes — state makes up 7 percent of the total, with the average local tax at 2.46 percent. This is according to the Tax Foundation, an independent tax policy nonprofit.

Though Tennessee’s sales tax did not increase, this new development comes shortly after Nashville’s unsuccessful transit plan referendum, which proposed funding a multibillion-dollar transit package with, among other revenue streams, a 1-percent sales tax increase.

No Tax 4 Tracks, a group that advocated against the transit plan, latched onto the sales tax hike, which would have resulted in Nashville having the highest sales tax rate in the country.

The Tax Foundation report emphasizes that the sales tax data "should be considered in context."

"For example, Tennessee has high sales taxes but no wage income tax, whereas Oregon has no sales tax but high income taxes," reads the report. "While many factors influence business location and investment decisions, sales taxes are something within policymakers' control that can have immediate impacts."