Rep. Ryan Williams

The Tennessee General Assembly’s $52.8 billion budget included at least one thing Republicans and Democrats could agree was positive: a $100 million addition to the state’s Rainy Day Fund, bringing the total to $2.15 billion.

“There was only about $580 million in the Rainy Day Fund [in 2010],” says Rep. Ryan Williams (R-Cookeville), chair of the House Appropriations Subcommittee. “We try to have a percentage, usually 10 to 15 percent of the total budget, in the Rainy Day Fund in case there is an emergency.”

Williams says the cash the state has on hand because of the Rainy Day Fund contributes to Tennessee’s good bond rating, which is also important for local governments to get lower interest rates when borrowing money.

“Certainly putting money in a Rainy Day Fund is a better use than just sending it out for corporate tax refunds,” says Sen. Jeff Yarbro (D-Nashville).

House approves three-year refund; Democrats blast transparency provision

While this year’s Rainy Day Fund deposit brings the total to the highest it’s been in state history, legislation adjusting Tennessee’s franchise tax will cost the state nearly the same amount — $1.95 billion. Gov. Bill Lee says the state will avoid lawsuits by removing the franchise tax property provision and giving $1.56 billion back to businesses who paid on that metric previously. Removing that provision also decreases recurring revenue by $393 million. Because revenue for FY24 is falling short of estimated projections, there is $150 million in the FY25 budget for that undercollection.

“We are heading for increasingly difficult budget years due to the governor and legislature’s own decisions,” says Yarbro. “The economy is not slowing down, but revenue growth is flattening, and that is a direct response to the governor’s decisions.”

While that revenue growth has been slower than expected, Gov. Lee said after the end of the session he wasn’t concerned because over the past three years revenue has grown. Williams agrees, saying the growth has moved to the state because of the tax benefits to businesses.

“My expectation is that revenues will continue to grow, not at the rate that we’ve seen in the last five years, but a more normal rate between 2.5 and 4 percent just based upon population growth,” Williams says. “I don’t think that this tax cut is going to be an impediment. I think it’s going to be an opportunity.”

Williams says it could be time for the legislature to cut food or sales tax, noting the initial rise of the sales tax to 7 percent in 2002 was originally intended to have only lasted for a few years.

Lee’s pitch created a divide among Republican legislators and faced widespread criticism from school leaders

While $150 million goes back into last year’s budget, $144 million for Gov. Lee’s Education Freedom Scholarships — school vouchers — will not be spent this year since no supporting legislation passed. It will roll back into the General Fund for use in FY26.

“Parking $140 million that should be going to schools in the budget for next year’s attempt at vouchers is ridiculous,” Yarbro says. “It’s really interesting to me that we pass the budget before making decisions on these gigantic financial issues. That’s what’s really unusual here.”

While discussion about the franchise tax was ongoing when the budget passed, the plan for vouchers seemed dead to everyone in the Capitol except the governor.

“Quite frankly, it was out of respect for the governor’s plan,” Williams says. “We felt like it was best not to spend that money and give him ample opportunity to do it because it was in the 11th hour when the budget was already set by the time he decided to punt until next year.”

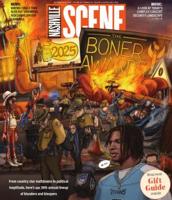

From the governor’s failed voucher plan to culture-war legislation and a whole lot more